I was listening to author Steven Pressfield the other day talking about the difference between doing something like a pro or like an amateur.

And it made me think about running your money life as a pro or like an amateur.

How does a pro go into the day?

If it’s a professional dancer, they practice, practice, practice even when they are sore or tired.

If it’s a pro tennis player like Serena Williams, they don’t hide their head in the sand if they don’t win a match. They face the truth and look for ways to improve.

Be a pro with your money life.

Because your money life is really just your life.

Look at the numbers even when you don’t want to.

Make choices even when you want everything in the store.

If you want to grow your life and evolve, your brain is going to throw up some resistance.

Your brain is going to create some fear and maybe a touch of shame or unworthiness around money.

So expect it.

And handle it like the pro you choose to be.

I so wish I could tell you exactly what to do to fix your money life.

Well, I could give you some pretty good guidelines.

But each person has their own wants, desires and values.

And in my case, a spouse who is not a saver.

He is a good earner, but he sees no reason to save.

And that is fine, because I am a saver.

So we’re a team.

Do I want to change him?

Absolutely.

But I have tried everything I know, and that has not changed him.

He’s a human.

He gets to have his own thoughts, feelings and actions.

(Damn.)

So, it’s time for me to get a new car.

The old one needs a new steering something or other, and it’s so expensive it would cost more than the car is worth.

He wants to buy me a brand new BMW.

Payments are only $500 a month.

Well, I suggested we save up and buy it with cash.

I have always bought my cars with cash.

I don’t like paying interest on a car that is losing value every day, whether I drive it or not.

That’s not just BMWs, that’s all cars.

And I love him for wanting it for me.

For some people driving a brand new car makes them feel secure.

For me it’s having money in the bank available for things like trips or emergencies.

We are two different people with different desires.

We have different ways of getting to the same place.

And different things make us feel secure.

And that’s OK.

Neither of us is right or wrong.

I could choose to feel insecure because he won’t save.

But that wouldn’t serve me.

Or him.

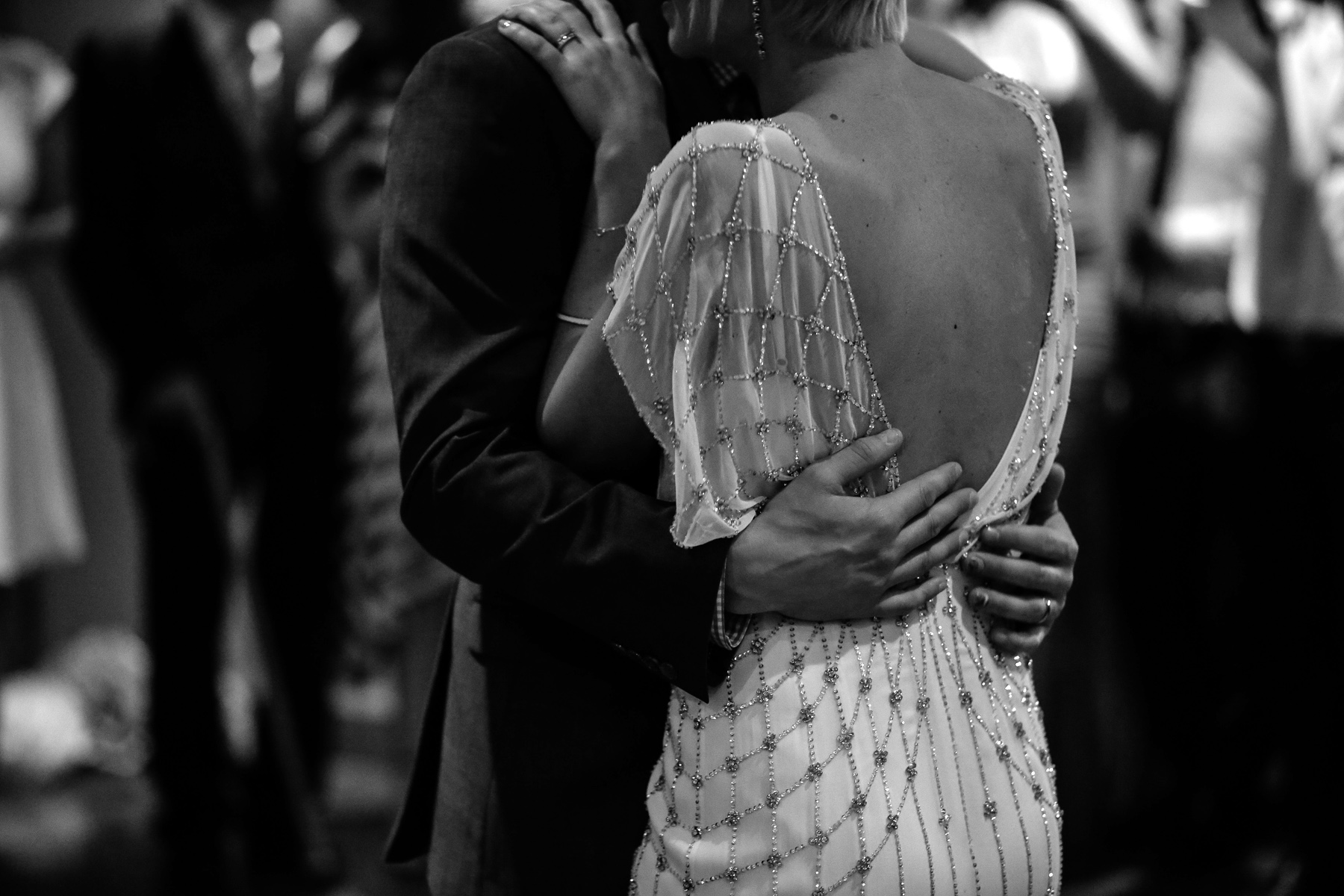

We have this beautiful dance we do with money and values and loving each other and honoring each other’s feelings.

The security is in the communication and owning who we are.

The security is in the dance and knowing that we have each other’s back.

Making money decisions

What to do… what to do…

When you are making decisions about your money, it’s hard to know what to do.

You have so many thoughts about what you “should” do.

I “should” stick to a budget.

I “should” look prosperous.

I “should” be generous.”

I “should” have a new safe car.

Whew.

You also have a lot of messages from your past and how you were brought up that steers your decision-making.

The human brain is amazing.

And it gives you a lot of conflicting opinions.

Faster than the blink of an eye.

Often without even registering as thinking.

It just seems like how things are.

Fear not, friend.

You have a compass you carry with you that has got your back.

Listen to your body.

Your body is like the kid who can’t keep a secret.

Your body always tells you the truth.

If you go into the car dealership just to look, and you find yourself signing on the dotted line and driving away with a brand new SUV, your conscious and subconscious influences aren’t talking with each other.

You MEANT to stay within your budget.

You ACTUALLY let your immediate gratification go on a spree without permission from your managing mind.

Let’s get these two parts of you working together.

First, when you catch yourself about to do something you told yourself you weren’t going to do, take a deep breath.

Reengage with your physical self.

I use what I call the clean and dirty test.

I try out different options on my body.

I think about making car payments the next eight years.

Then I check in with my body.

If it feels a little dirty… unclean… I steer in another direction.

If I feel clean, I make the leap.

Sometimes I have to try out a few thoughts.

Maybe with an SUV I feel off… I feel dirty… icky.

But when I think about owning a four-door car, the feeling changes to clean.

Some people call this checking in with your gut, but often I feel it in different parts of my body. I may feel it in my back or my palms may be sweaty or tense.

Feel around all over your body.

This is a skill that takes some practice to get right, so try it first with some things that are less expensive than a car.

You want to have this skill fine-tuned when you are making a decision about a car or a house.

I like to use it to figure out what to watch on TV. When I am scrolling through, if I catch myself flashing a little tiny smile, that’s the show that’s going to satisfy me.

Try it with what you order at a restaurant. Read through the menu and pay attention to how your body reacts. It’s a fun thing to try.

Your subconscious can hide from your managing brain, but it can’t hide from your body.

Tune back into your body and use all of your resources to make your next money decision.